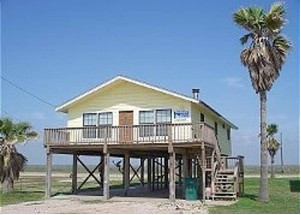

The warm fun days of summer have begun. Your summer dreams may include a “second vacation home”. So what kind of tax questions should I have about a second home?

The warm fun days of summer have begun. Your summer dreams may include a “second vacation home”. So what kind of tax questions should I have about a second home?What If the Home is Mostly Used by the Owner?

If the “second home” is rented out for 14 days or less during the year, it is a personal residence. You do not have to report rental income. You can deduct interest and taxes just like your first house. Subject to new interest and property rules under the 2018 law {the Tax Cuts and Jobs Act or TCJA}.

What If the Home is Mostly Used by A Tenant?

If the “second home” is rented out for more than 14 days during the year, it is investment property. You have to report rental income.

You can normally deduct expenses of an investment property utilities, maintenance, etc. Also includes your cost of travel to the property to make repairs. IRS has also liberalized the rapid expensing of capital improvements {Landscaping, Built-in cabinetry, et al}. TCJA may also allow a new 20% deduction of net income. You may be able to generate a tax loss to shelter other income; your loss might be limited by passive loss rules.

Deductions can get complicated because you have to allocate your expenses between the time the property is used for personal purposes and investment purposes.

What Happens When I Sell?

If you sell your “second home” as a personal residence, but not as your primary residence, you cannot use the capital gain exclusion of up to $500,000 from the sale of your primary residence. However, under TCJA, you can still get around this limitation if you covert your “second home” into your primary residence.

If you sell your “second home” as investment property, you must pay the capital gains tax on the profits from the sale of the investment property. Profit would be the portion of the proceeds from the sale of your investment property which exceeds what you paid for your

second home”, plus the cost of any capital improvements {net of any depreciation or rapid expensing}, plus any closing costs associated with the sale, AND the buy, of the investment property.

Is There Another Option Available?

If you treat your “second home” as investment property, there is a potential to escape capital gains tax through a 1031 exchange. In short, this means swapping one piece of investment property with another piece of investment property in a short period of time or the entire gain is taxable.

If you do not follow the rules for like-kind exchanges, you are subject to large penalties and interest from IRS, as well as the unpaid tax! Under TCJA, the rules of what defines a piece of investment property that is eligible for a 1031 exchange are stricter.

Make sure you use a qualified 1031 exchange intermediary for the actual exchange. Also use a tax professional who comprehends 1031 exchanges.

The Tax Rules for a Second Home Seem Murky. So What are My Tax Opportunities then?

The answer lies in your lifestyle choices. Do you desire property for fun and leisure? Do you seek an income producing property that pays for itself? Or a hybrid of both?

John J. Kasperek, EA, is a tax professional who comprehends the murky IRS regulations regarding the “second vacation home”. He and his awesome staff really can help you realize your dream from a tax perspective!